Payroll End-Of-Year Process for 2022-2023 Financial Year

Eclipse Payroll v8.90 is needed to perform EOFY for 2022/2023

You must be running Eclipse Payroll version 8.90 or later in order to perform EOFY processing for 2022/2023.

You can determine what version of Eclipse Payroll is installed by viewing Help→About.

You can download the latest version of Eclipse Payroll by selecting Help → Check Update.

Follow the steps below to finalise your Payroll for the 2022-2023 Financial Year and enable Payroll processing for the 2023-2024 Financial Year.

Note that Single Touch Payroll (STP) is now mandatory for all businesses.

If STP is not enabled in your system you should contact UBS Support immediately. If you're unsure of whether or not STP is enabled, see here for information on how to determine this: What version of STP am I using?

Note also that STP Phase 2 has just been released by the ATO and you should have already transitioned from STP1 to STP2!

If you have not done so we urge you to do so before starting the End Of Year process.

You can find STP2 Transition instructions here.

Important

These End of Year Instructions assume you are using Single Touch Payroll. Please contact the Ultimate Support Team if you are NOT using STP.Important

These EoFY Instructions apply whether you are using STP1 or STP2. However it is highly recommended you transition to STP2 if you are still on STP1 and that you do this before attempting EoFY for this year.Employees

The term current employee is used below to refer to any Employees who have received a Pay during the current 2022/2023 Financial Year.

The quickest way to locate this group of Employees is to open the main Employee List and filter for any current Employee (not Terminated), or any Employee Terminated during the current FY (you can sort by the Termination Date to find these).

Preparing for EoFY

You must run and commit all Payruns for all Pay Schedules for the current Financial Year. Once you commit the last Payrun for the FY, note that the Payrun Screen will prompt you to perform EoFY processing.

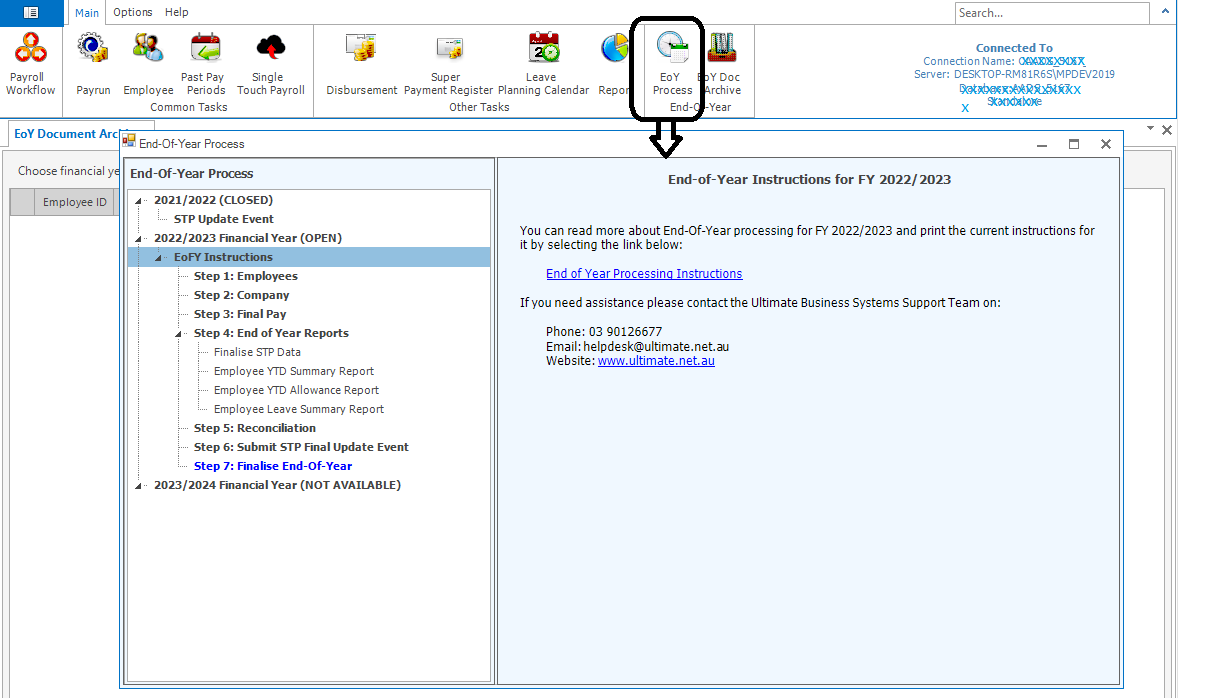

Introduction

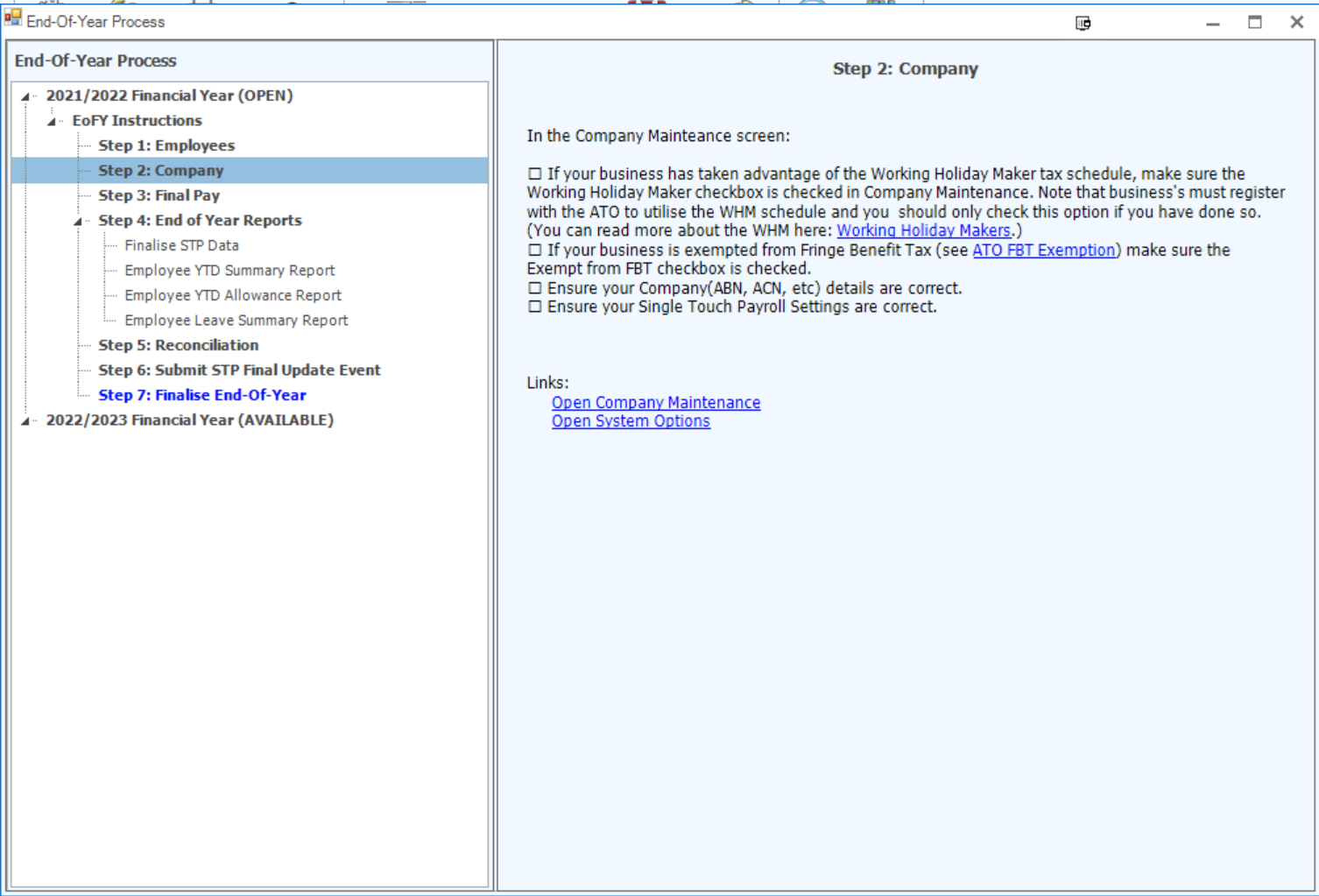

Access the End Of Year screen and work through the EoFY Instructions shown under the 2022/2023 Financial Year node.

The individual Steps are explained below.

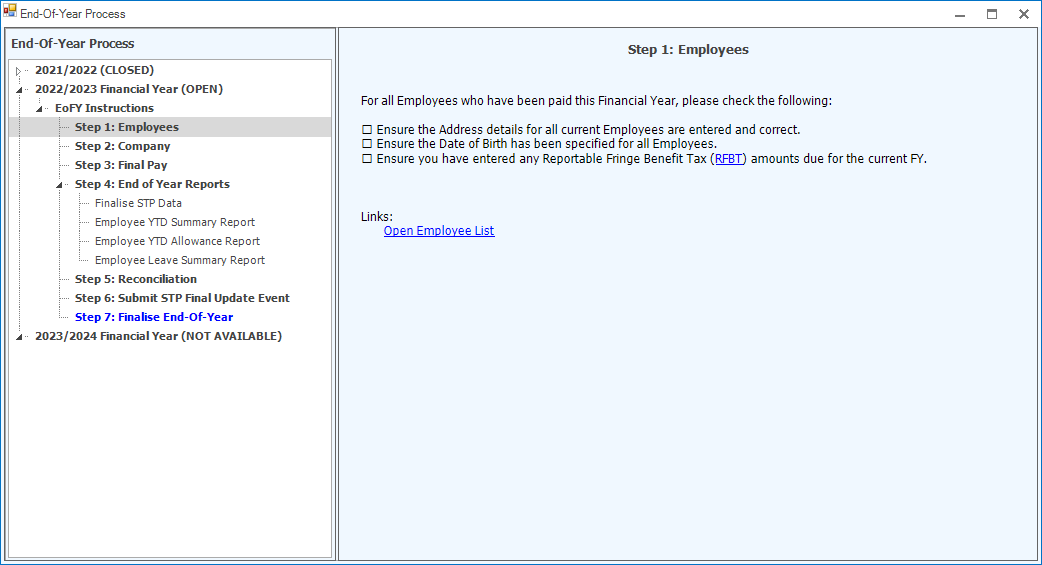

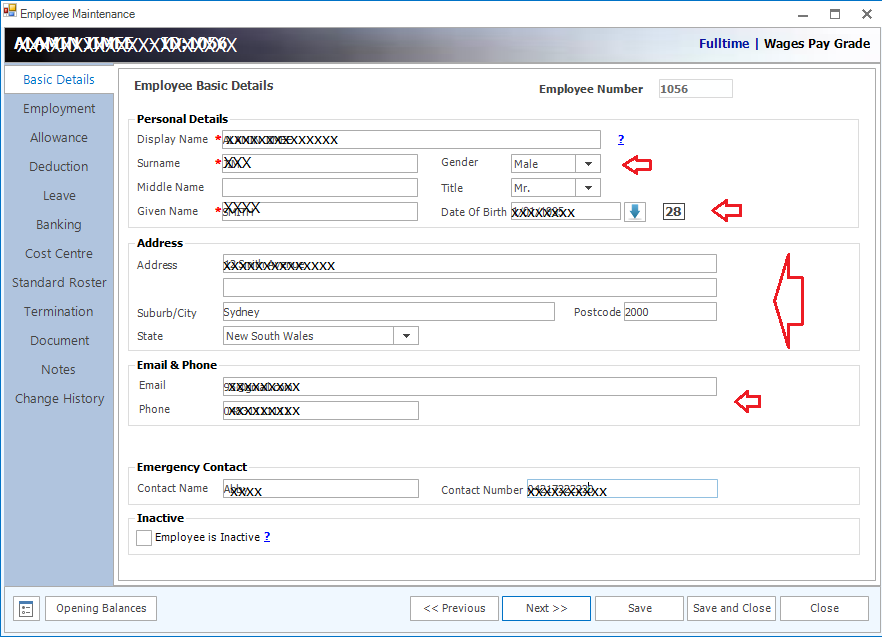

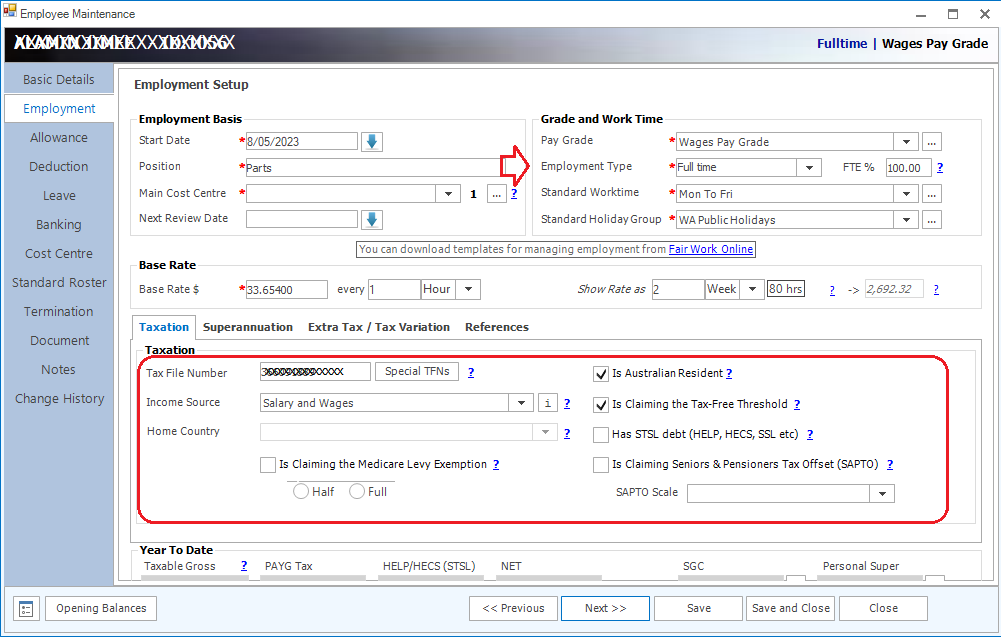

Step 1: Employees

Make sure your Employee's are set up correctly. All Employees must have a valid and current address specified. Employee Birth dates must be specified also.

We've highlighted in the screen shots below the most common causes of EoFY/STP errors as far as missing Employee information goes.

- Ensure the Address details for all current Employees are entered and correct.

- Ensure the Date of Birth has been specified for all Employees.

- Check that the phone and email details are valid if supplied.

- Be sure to confirm the Taxation setting for your Employee are correct.

- If any Employees have a Reportable Fringe Benefit Tax requirement then this needs to be entered into their Taxation setup in their Employment details.

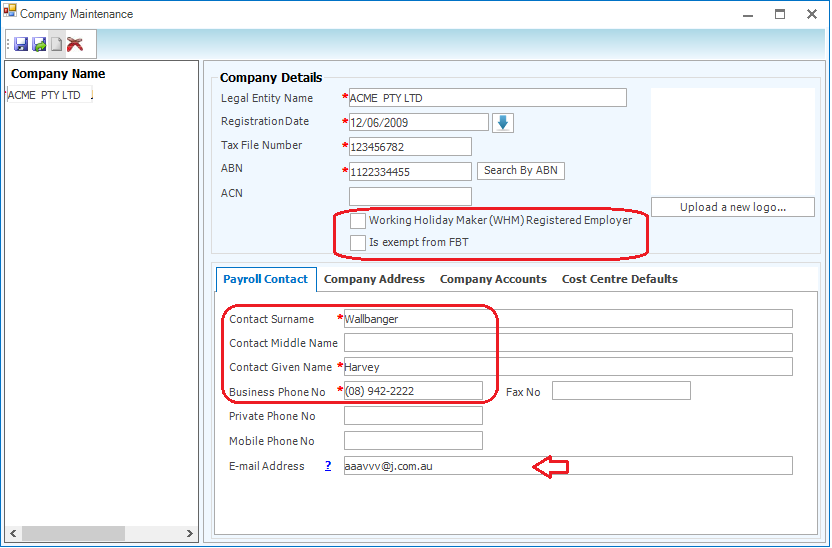

Step 2: Company

Check your Company Setup is correct.

- If your business has taken advantage of the Working Holiday Maker tax schedule, make sure the Working Holiday Maker checkbox is checked in Company Maintenance. Note that business's must register with the ATO to utilise the WHM schedule and you should only check this Checkbox if you have done so. (You can read more about the WHM here: Working Holiday Makers.)

- If your business is exempted from Fringe Benefit Tax (see ATO FBT Exemption) make sure the Exempt from FBT checkbox is checked in Company Maintenance.

- Ensure your Company (ABN, ACN, etc) details are correct.

- Make sure your Single Touch Payroll settings are correct.

- Note that a Contact Email address must be supplied also.

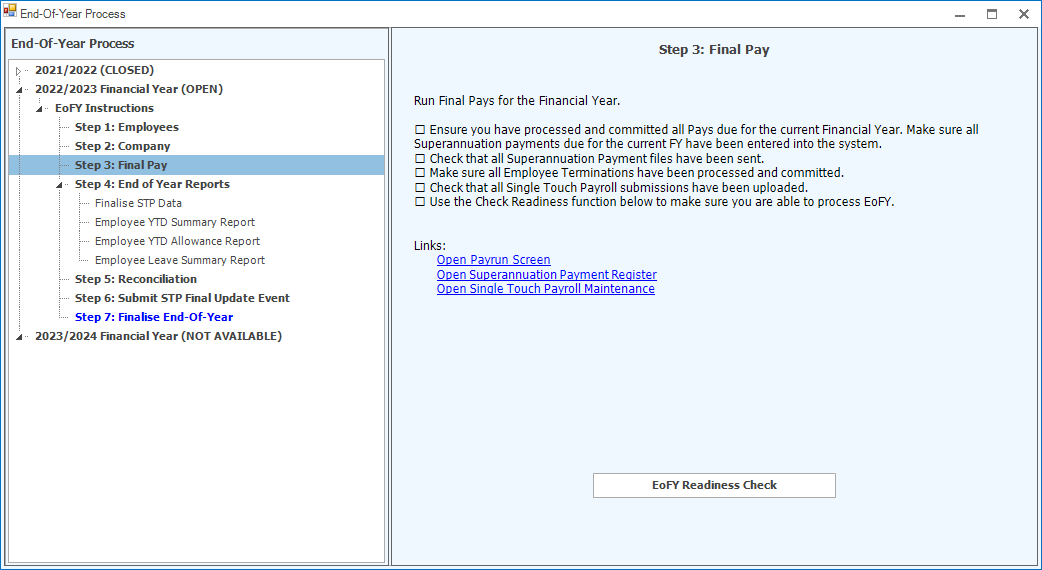

Step 3: Final Pay

Make sure you finished all Pays for the Financial Year. You can check this by selecting the "EoFY Readiness Check" function in this screen.

- Ensure you have processed and committed all Pays due for the current 22/23 Financial Year.

- Make sure all Superannuation payments due for the 22/23 FY have been entered into the system.

- Check that all Superannuation Payment files have been sent.

- Make sure all Employee Terminations have been processed and committed.

- Check that all Single Touch Payroll submissions have been uploaded.

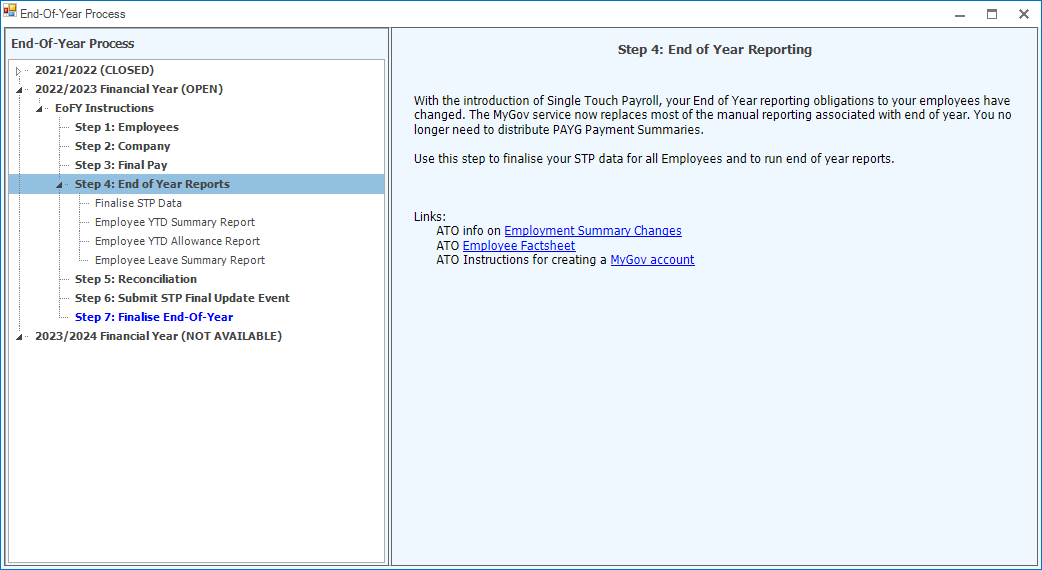

Step 4: End of Year Reporting

This step allows you to Finalise your STP data for all Employees for the FY and to run End Of Year reports.

EOY Reporting

With the introduction of Single Touch Payroll, your End of Year reporting obligations to your employees has changed. The MyGov service now replaces most of the manual reporting associated with end of year.

- Business's are no longer required to provide their Employees with a payment summary for the information reported and finalised through STP.

- Employees can access their year-to-date and end-of-year income statement online through myGov or talk to their registered tax agent.

- 'Income Statement' is the new term for an Employee's payment summary.

- Employee's need to wait until their income statement is 'Tax ready' before lodging their tax return.

- Employees must ensure they check their personal details and if necessary, update with both you and the ATO (incorrect personal details may prevent them from seeing their STP information).

- You should advise your Employees to create a myGov account if they do not already have one.

- Direct your Employees to these ATO links for more information on end of year reporting changes:

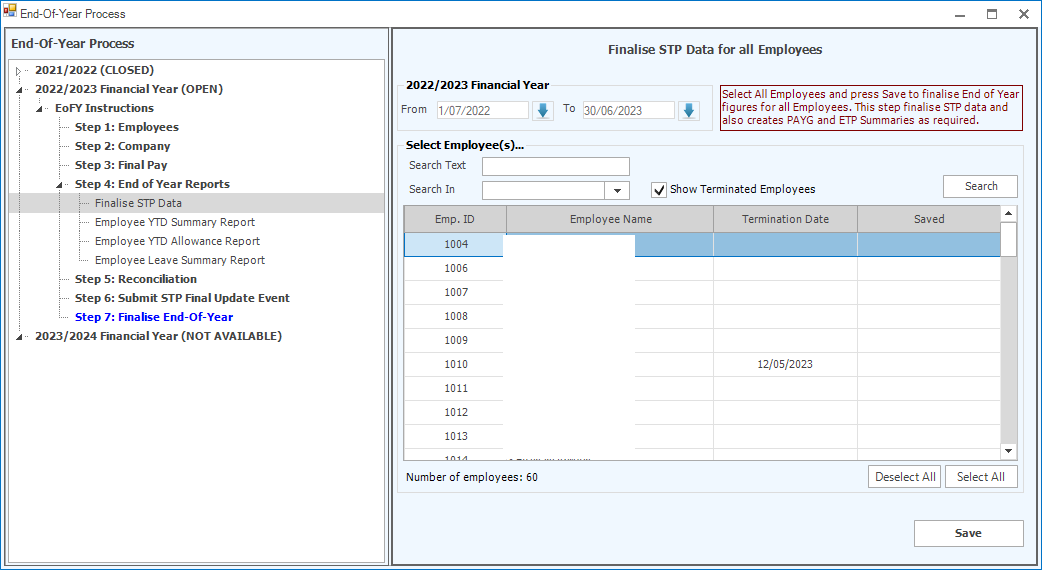

4.1: Finalise STP Data for end of year.

Use this step to finalise you Single Touch Payroll data for all Employees so this can be submitted to the ATO and made available in MyGov for each Employee.

Select all Employees to be finalised and then choose the Save button to commit their STP data for the FY.

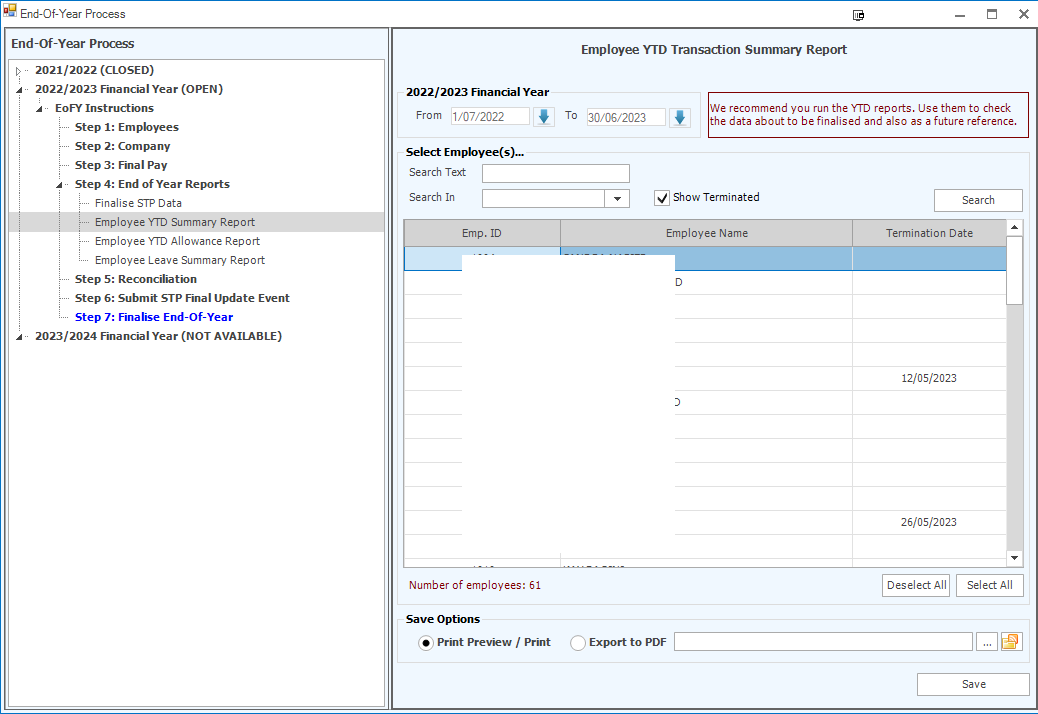

4.2 Employee YTD Summary Report

This is an optional report you can produce to assist with reconciliation of your data. This report shows the YTD Summary by Employee.

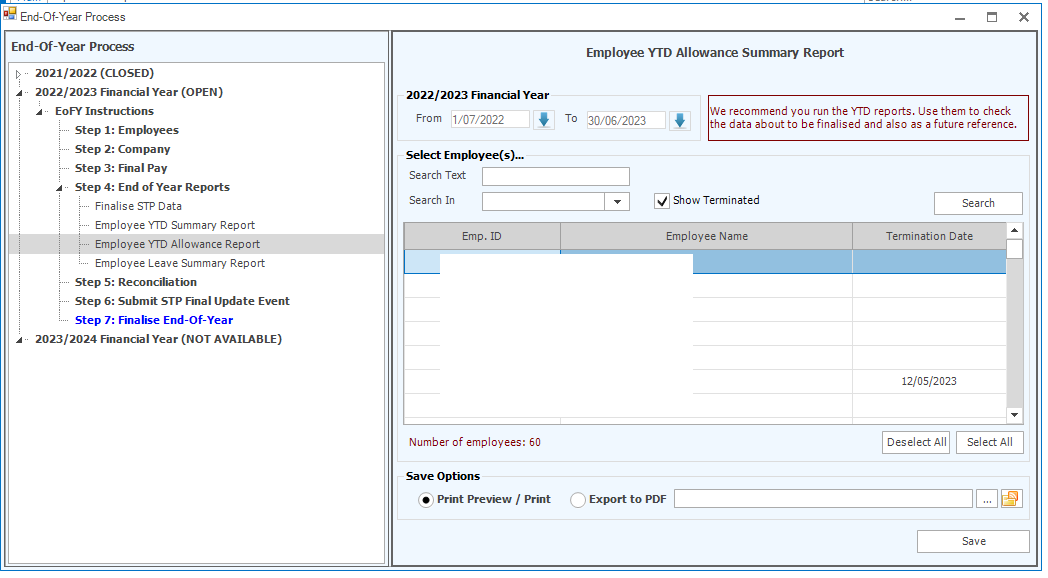

4.3 Employee YTD Allowance Summary

This is an optional report for check Allowances paid.

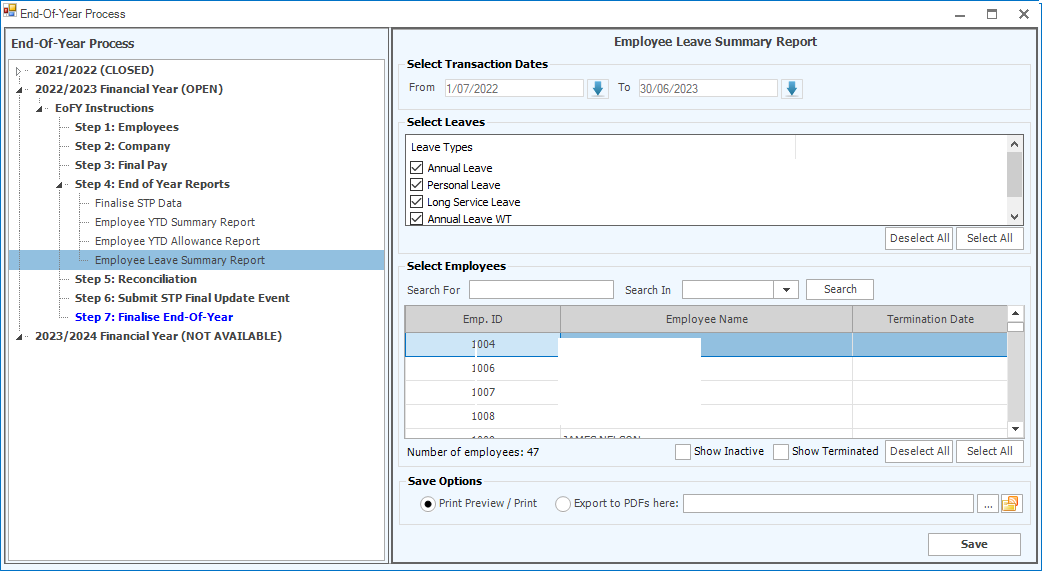

4.4 Employee Leave Summary

This report allows you to examine Leave Summaries for your Employees.

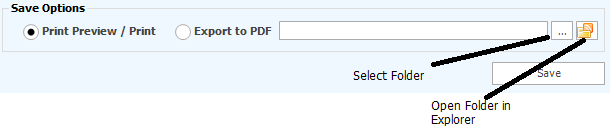

Save Options for all End Of Year reports

Note that you have two options for Creating and Saving the End of Year reports:

- You can print the Reports to a Printer. Once the Reports are successfully printed, they will be saved as PDFs to the database.

- OR you can Export the Reports directly to PDF and saved to a Folder location on your PC or network. Once the PDF is created, it will be saved to the database. You must select a Folder to store the PDF files.

Step 5: Reconciliation

Reconciliation

Reconciliation is an optional step but it is highly recommended. Do not Finalise EoFY if you discover reconciliation errors. Fix the errors first.

You should reconcile the following:

- Payroll information posted to the General Ledger.

- PAYG obligations against actual tax paid to ATO

- Gross Income

- Superannuation obligations

- Third Party Deductions

- Payroll Tax

- JobMaker/JobKeeper

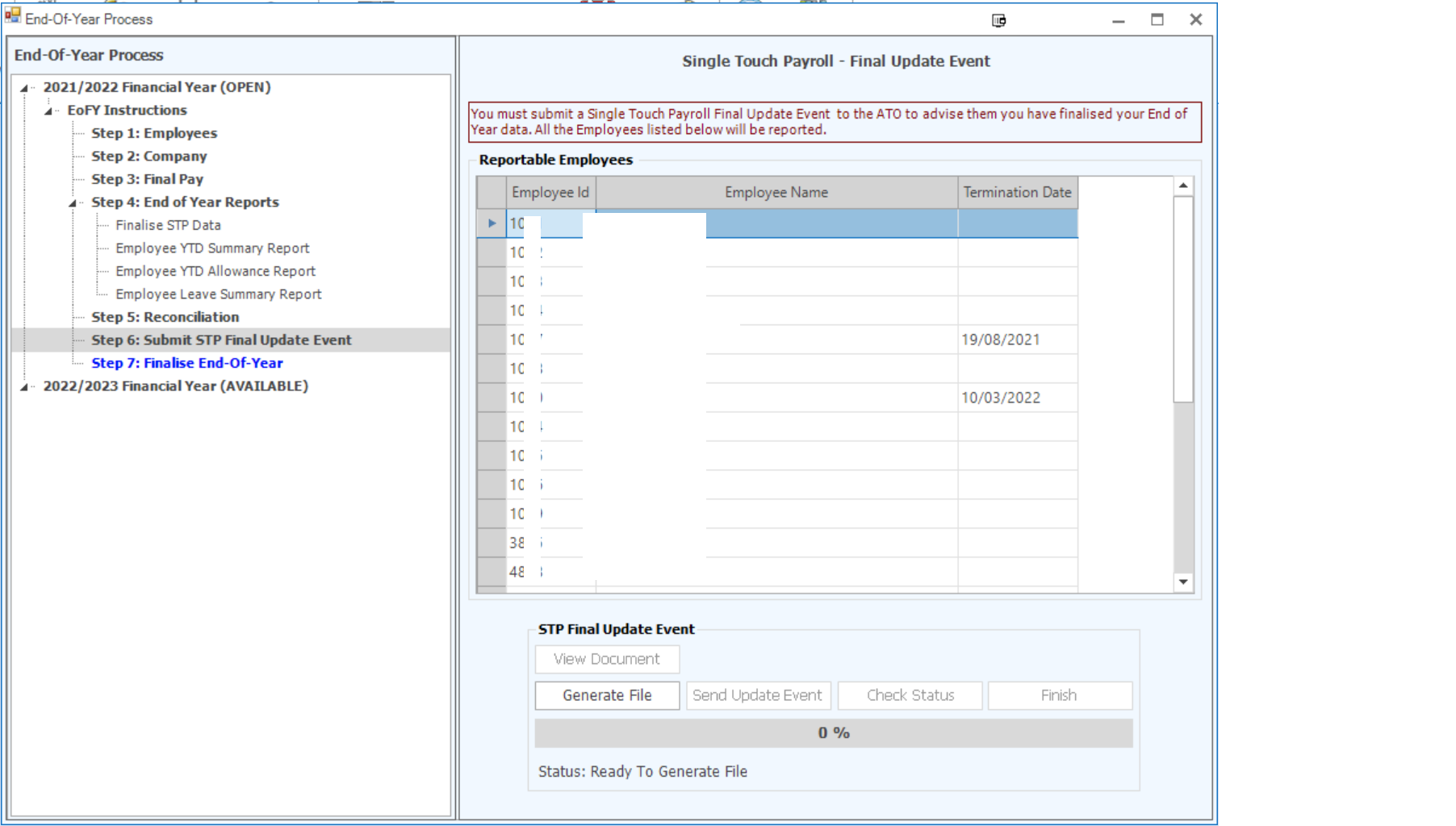

Step 6: Submit STP Final Update Event

Create and upload the STP Final Update Event. This will finalise your End of Year data with the ATO. Employees that you finalised STP for in Step 4 will be shown as reportable Employees in the list.

To create the STP Update Event that will finalise STP data for those employees, select the Generate File command. This creates the File which you can then use the Send Update Event commend to lodge with the ATO. It can take several hours for the ATO to process the file and you should wait until it is shown as Submitted before moving to the next step.

- Check that the Reportable Employees list shows all relevant Employees.

- Create the STP File

- Submit the STP File

- Finish the STP Process.

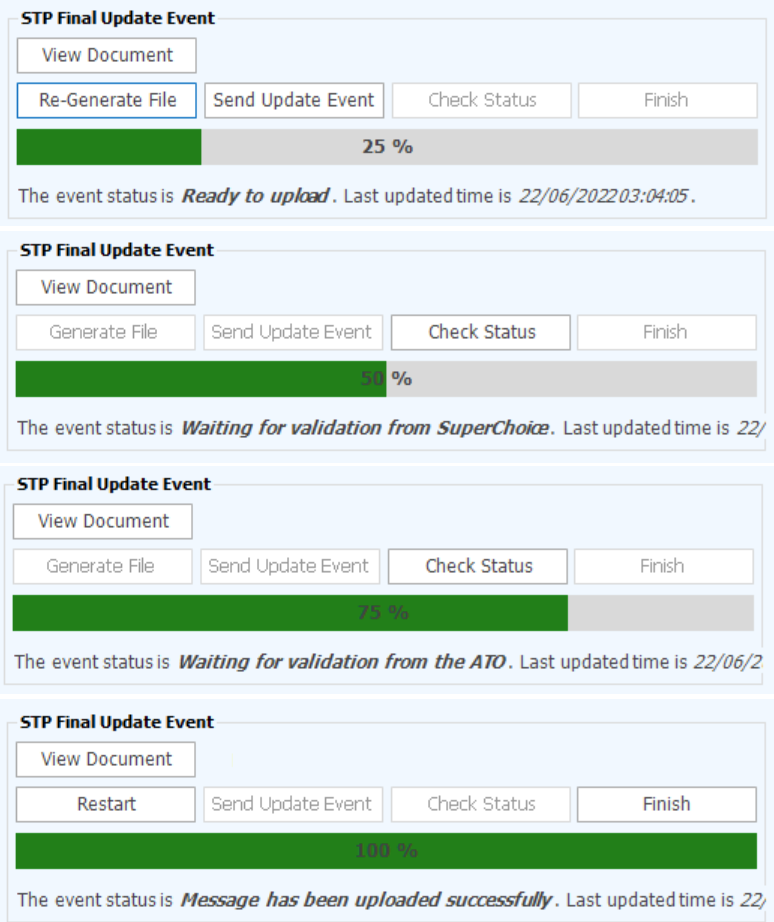

You STP Document will move through several stages as shown below. Once it has uploaded select the Finish command to finalise the STP upload.

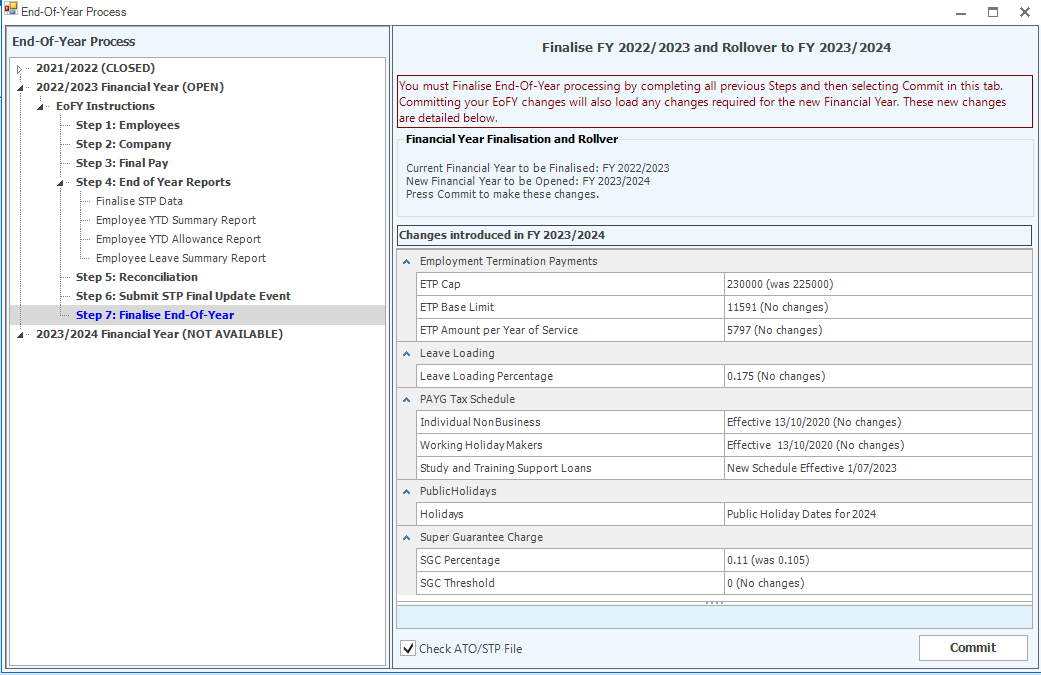

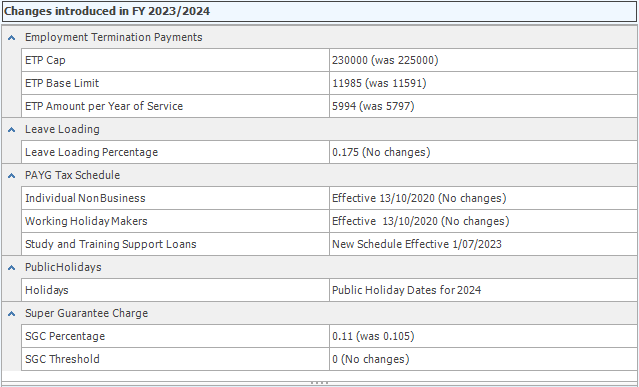

Step 7: Review the Payroll changes that will affect processing in the coming 2022/2023 Financial Year.

The ATO has introduced a number of changes that will take effect on 1 July 2023.

Those affecting Eclipse Payroll for FY23/24 are:

Commit Changes

Select the Commit Button to Finalise End of Year processing for the 2022/2023 FY.

Note that the Commit process implements all changes for FY2023/2024 as shown above.

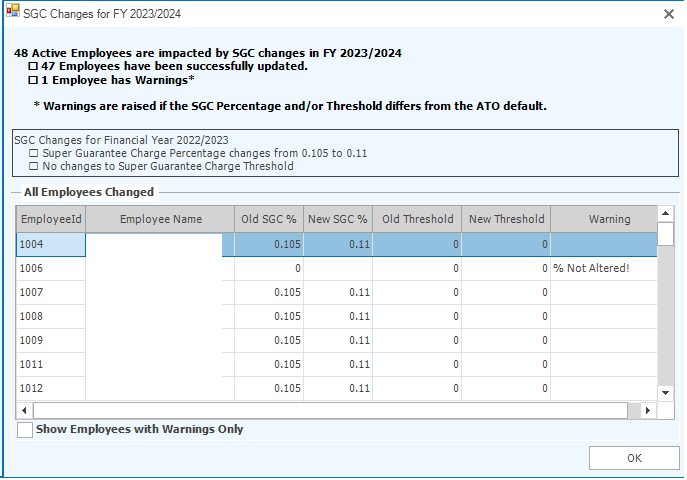

Additionally, the system will scan and update Employee data related to the Superannuation changes according to the following rules:

- If the SGC rate for any current Employee is 10.5% or less, the system will raise the rate for them to 11% automatically.

- If the SGC rate for any current Employee is greater than 10.5%, it will not be modified by the system,

The result of this work is displayed in dialog screen that appears when you press Commit.

Doing so will also implement the above changes for the forthcoming 2023/2024 Financial Year and will open up that FY for running Pays.